A BEAUCLAIR CLIENT case STUDY OF YORK CITY CENTRE

Diane Wehrle, brand ambassador for Beauclair, recently had the pleasure of presenting to York’s businesses during an event hosted by York BID. The theme of the presentation was “The Performance of York’s High Street”, and it was a fantastic opportunity to convey the success of York to date through Beauclair’s data, and the opportunities that the City has to deliver even better performance going forward.

York’s story is a positive one, with the City has recording rises in both footfall and sales over the past 12 months (Feb 2024 to Jan 2025) in the face of a national decline in both. Its footfall rose by +8.5% versus a decline nationally of -0.4% (MRI), and sales in York rose by +1.8% whilst they declined across UK towns and cities by -3.8% (Beauclair).

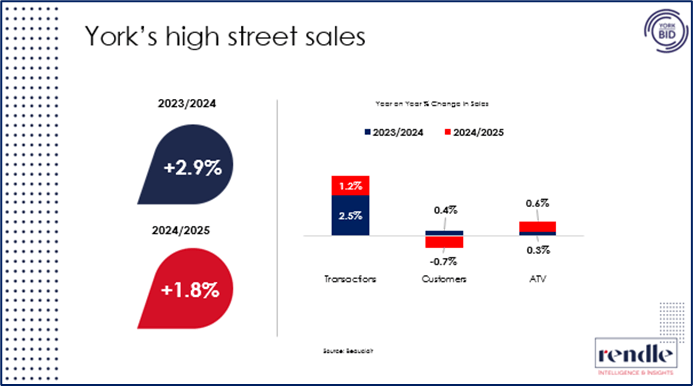

However, it is by examining Beauclair’s sales data in more detail that unwraps the reasons for York’s success in driving up its revenue. Firstly, whilst sales increased last year by +1.8%, the uplift slowed from the year before when sales rose by +2.9%. This suggests that there are opportunities for the city centre to increase the momentum of sales growth.

Total sales is derived from a combination of three key metrics; the number of customers purchasing, the number of transactions they make and the average transaction value of each transaction (ATV). Whilst York’s footfall rose over the past 12 months the number of customers decreased marginally (-0.7%). But despite fewer customers making purchases in the City, both the number of transactions and the ATV of those transactions rose (+1.2% in transactions and +0.6% in the ATV).

York’s positive sales performance last year contrasts sharply with the national picture for the same 12 months, which revealed a decline in all three metrics, with the most significant drop occurring in customers and transactions (-2.9% and -3.4%) and a marginal decline in ATV (-0.3%).

This suggests that over the near future the City should not necessarily expect a significant rise in the number of customers who purchase. Therefore, to increase the momentum of sales growth over the coming year, the City needs to focus on two key objectives 1) increasing the number of transactions that customers make and 2) driving up the ATV of transactions.

So how can the Beauclair data help us to understand the ways this can be achieved? Firstly, identifying the sectors that generate the greatest amount of revenue is key. Beauclair provides sales data for 10 sectors, and nationally the two sectors of Fashion and Food & Drink are most significant; Food & Drink accounts for 25% of revenue and Fashion 24%. Together with these two sectors, three other sectors account for 85% of revenue in towns and cities; Grocery (18%), Health & Beauty (11%) and General Retail (9%).

In York the same five key sectors also generate 85% of the City’s sales. However, a key difference is that a far greater proportion of revenue is accounted for by the Food & Drink sector (38% vs 25% nationally), and a smaller proportion by Fashion (16% versus 24% nationally). This difference is a clear indicator that York has a greater leisure/experiential element than the average for UK towns and cities, and less exposure to Fashion, reflecting its attraction as a historic and tourist destination. Furthermore, Tourism spending (which comprises, airlines, hotels and holidays) whilst representing only a modest proportion of revenue is twice as significant in York as it is nationally (6% vs 3%). Clearly some of this revenue will have been generated by locals visiting other locations, however, the fact that its representation is double that nationally is further evidence of the diversity of the City’s economic base.

So how did each sector perform over the past 12 months? Examining this enables us to get a clearer steer on the city’s performance and the outlook over the next year. In three of the five sectors sales in York rose over the past 12 months from the previous 12 months and, importantly sales in Food & Drink – the sector that generates over a third of all sales in the City – sales rose by +2% compared with a drop of -1.3% nationally. The other two sectors which recorded a rise in sales were Grocery (+6%) and Health & Beauty (+1%). Sales in both Fashion and General Retail declined (by -3% and by -1%) but the drop in Fashion sales in York of -3% was only a half of the -5.7% drop in Fashion sales nationally.

The strength of York appears to emanate from only a small percentage drop in customers and transactions, alongside a resilient ATV, which increased or remained flat from last year in four of the five key sectors. It was only in the Fashion sector that the ATV declined, however, at -2.9% this was a slightly greater drop in ATV than the -2.1% drop nationally.

In addition to the five key sectors, the other notable improvement in sales was in Tourism sales rose by +17% annually last year due to increases of more than +20% in both customers and transactions. Whilst this sector accounts for a smaller proportion of sales than the five key sectors, and some of this spending will be on tourism outside of York, it’s highly likely that the City will have captured a proportion of this uplift through spend on hotels. Whilst Tourism spend rose last year, spending in the Entertainment sector – which comprises attractions – declined by -12%. This spending is clearly associated with Tourism, however, the drop in spending on Entertainment alongside a rise in Tourism spending suggests that customers are being more discerning and opting to visit fewer attractions during their visit to the City.

It is evident that the diversity of spending within York has meant that the City’s sales have grown over the past two years in the face of a challenging trading landscape for high streets nationally. By identifying the sectors and metrics that are key to its performance there are some clear opportunities for York to continue to deliver sales growth.